Stablecoins: A Quiet Revolution

Stablecoins: A Quiet Revolution

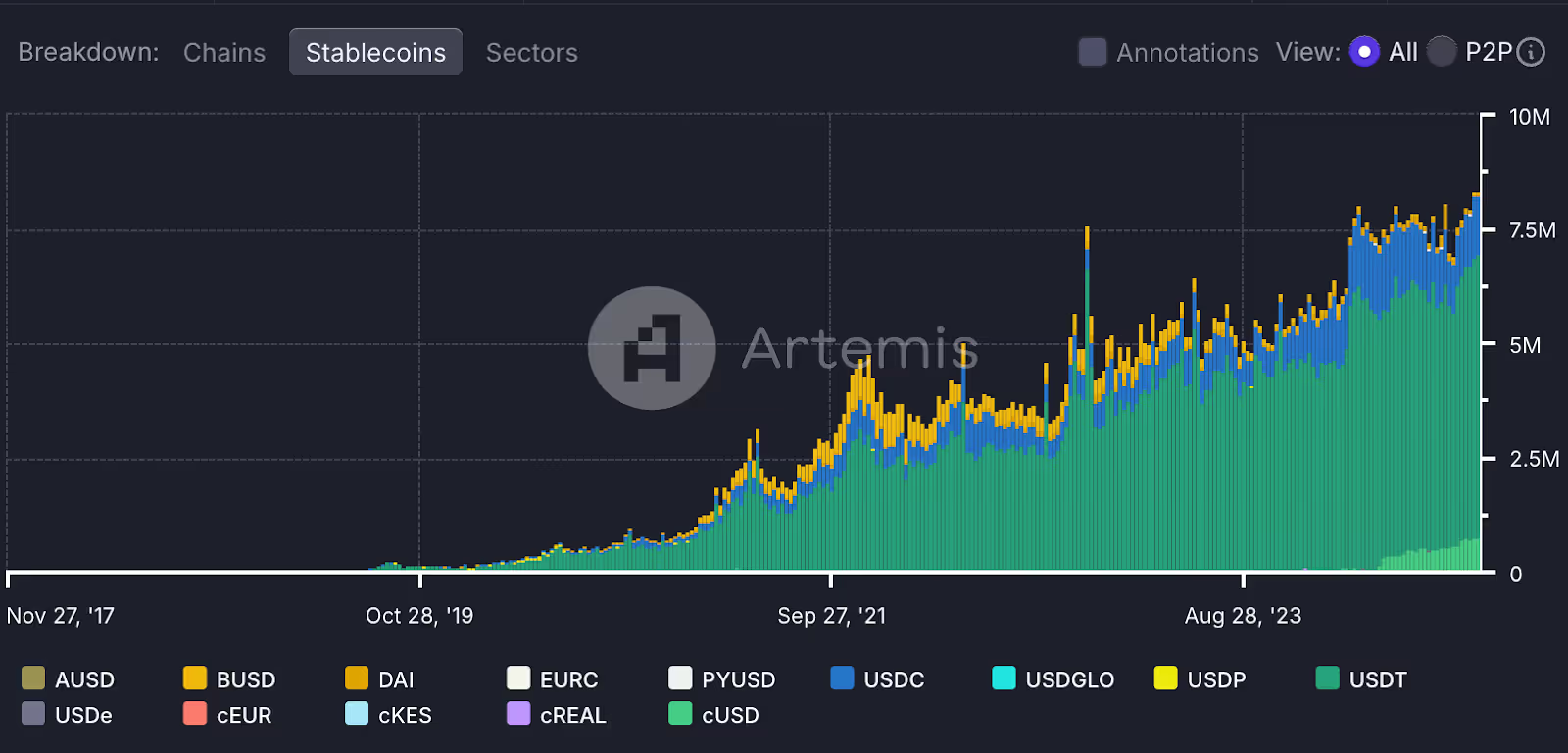

In the decade since the first stablecoin was minted, they have emerged as a potentially transformative force in global finance and—without a doubt—the clearest case of product-market fit within crypto.

As of today, total stablecoin circulation has exploded to over $160 billion, with over 20 million unique wallets transacting with stablecoins on public blockchains every month. Established financial institutions are waking up to their potential as well, with JPMorgan Chase, Mastercard, PayPal, and VISA all adopting or issuing their own stablecoins. Recently, payments behemoth Stripe announced its acquisition of Bridge (a Haun Ventures portfolio company), a two-and-a-half-year-old company using stablecoins to simplify global money movement.

Despite their recent proliferation, stablecoins remain poorly understood by the general public and policymakers alike. For those who don’t spend their days enmeshed in markets, it’s too easy to see these tokens merely as digital dollars designed as a trading pair for crypto tokens. Stablecoins’ crypto origins belie the profound ways in which they are reshaping payments and settlement on a global scale.

Many Countries, One Payments System

Stablecoins invert the traditional paradigm of expanding payment networks. In conventional finance, supporting payments in any given country requires establishing local banking relationships and integrating with local payment rails, jurisdiction by jurisdiction. When you’re talking about financial institutions that may be trying to reach consumers and businesses in 150+ countries, accomplishing this is a herculean task even for the largest financial institutions. This is to say nothing of the costs and effort involved in ongoing maintenance of infrastructure and relationships, which are themselves considerable.

Stablecoins flip this model on its head. Rather than each institution needing to integrate with systems jurisdiction-by-jurisdiction, every country can integrate directly with one global platform. Because they operate on open blockchain networks, stablecoins offer instant worldwide reach by default. Any financial institution or business that integrates stablecoin technology immediately gains the ability to transact with anyone who has a compatible digital wallet.

This inversion also dramatically lowers the barriers to creating companies capable of interfacing with global payment networks—thanks to stablecoins, even small startups can offer cross-border transactions. Bridge is an excellent example. Using stablecoins, the company makes it possible for any company to leverage its APIs to move money around the world in minutes, not days, and at a fractional cost to legacy offerings.

Of course, converting fiat currencies to and from stablecoins still requires some level of local financial infrastructure, in addition to the other benefits that local institutions provide. But the complex coordination connecting hundreds of different systems, has been abstracted away to a global, interoperable layer.

Smoother Rails, More Efficient Transit

Stablecoins also enable a step-change improvement in settlement efficiency and risk management. Traditional payment networks typically settle transactions in batches, often at the end of each business day. This creates significant counterparty risk, as there can be a lag of hours or even days between when a transaction is initiated and when it is finally settled.

Stablecoins, by contrast, allow for near real-time settlement at negligible cost. The result is reduced counterparty risk and working capital requirements—akin to moving from mid-20th Century retail credit arrangements with monthly or quarterly clearing, to modern-day credit cards with near-instantaneous clearing.

The implications for capital efficiency are profound. Businesses that previously had to maintain large cash reserves to manage settlement risk can now operate with much leaner balance sheets. This frees up capital that can be reinvested or returned to shareholders. It also eliminates many of the arcane but lucrative business models built around exploiting settlement delays, such as certain types of float-based revenue that exist only as a tax on market participants.

Modernizing Money for Governments

This utopian picture we have painted thus far of a more efficient, open system doesn’t address one major set of players with the most power and the strongest opinions: governments. From a regulatory and geopolitical perspective, stablecoins present both opportunities and challenges.

Critics often argue that governments will never allow stablecoins to become truly dominant due to concerns over monetary control. While it's true that stablecoins face regulatory hurdles, we believe this view misses several important realities.

First, in a world of 195 sovereign nations, there will always be jurisdictions willing to embrace financial innovation to gain a competitive advantage. Perfect global coordination to suppress stablecoins is highly unlikely.

Second, many governments already recognize the economic benefits and soft power advantages of fostering vibrant digital asset ecosystems. Nations like Singapore, Switzerland, and UAE are actively positioning themselves as hubs for stablecoin issuers and related businesses.

For the United States specifically, dollar-backed stablecoins—which constitute almost the entirety of the market today—may actually reinforce U.S. dollar hegemony, extending the reach of the dollar into previously inaccessible corners of the global economy and bringing more activity under the purview of U.S. regulators and law enforcement.

However, this very characteristic also raises concerns among other nations about monetary sovereignty and the further entrenchment of dollar dominance. Small countries, in particular, may worry about local currencies being displaced by digital dollars. This creates an interesting dynamic where some jurisdictions are racing to embrace stablecoins and capture the economic benefits of becoming hubs for digital finance, while others are more measured.

Stablecoins are not a monolith, though, and different designs can prioritize different properties. While many dominant stablecoins today offer full transparency, as is characteristic of digital assets built on an open ledger, it's certainly feasible to create stablecoins with more robust privacy features. The European Central Bank, for instance, has proposed designs for a digital euro CBDC that would use cryptographic techniques to enable private transactions below certain thresholds, which would enable digital Euro payments with cash-like privacy.

This highlights a key point: stablecoins are, at their core, programmable money. The current crop of transparent, fully-traceable stablecoins represent just the first iteration of this technology. As the ecosystem matures, we can expect to see a proliferation of designs optimized for different use cases and regulatory needs.

Unlike the opaque world of correspondent banking and the eurodollar market, stablecoin transactions have the potential to be highly traceable, whether because transactions are recorded on public blockchains or because of cryptographic technology like ZK. Either way, regulators and law enforcement may soon have vastly better tools at their disposal to combat money laundering and illicit finance. Transparency and programmability may also allow governments more effective tools for implementing monetary policy and financial regulation.

In short, there’s a lot to like about programmable, 24/7 money, borderless money—not just for the private sector but also for governments.

The Road Ahead

We should be clear-eyed about the potential tradeoffs of stablecoins, not just their benefits. The level of financial transparency they enable, while beneficial for combating financial crime, also raises significant privacy concerns if not architected with these concerns in mind. As active investors in crypto companies, we are very excited about this development area—there are already promising projects building solutions to this delicate balance of privacy and compliance.

While stablecoins can increase efficiency and reduce costs in many areas, they also disrupt existing business models. Companies that currently profit from the frictions in cross-border payments or from float income will face pressure to adapt or become obsolete. This creative destruction, while long-term beneficial for the broader economy, may cause short-term dislocations in parts of the financial sector in ways no different from those seen during other epochal shifts in how money is invested, moved, and stored.

From cross-border trade finance to micropayments for digital content, stablecoins enable new business models and markets that were simply not feasible with legacy systems. But the stablecoin revolution is still in its early stages. As this technology matures and becomes more widely adopted, it has the potential to remake global finance in a way that is more open, efficient, and inclusive.

The challenges are significant, but so too are the opportunities. How we navigate this transition will play a major role in shaping the future of money and global economic relations.